Navigating Financial Life: Understanding the Significance of Bank Holidays in 2025

Related Articles: Navigating Financial Life: Understanding the Significance of Bank Holidays in 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating Financial Life: Understanding the Significance of Bank Holidays in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating Financial Life: Understanding the Significance of Bank Holidays in 2025

- 2 Introduction

- 3 Navigating Financial Life: Understanding the Significance of Bank Holidays in 2025

- 3.1 Understanding Bank Holidays: A Crucial Element of Financial Planning

- 3.2 Key Factors Influencing Bank Holidays in 2025

- 3.3 The Impact of Bank Holidays on Individuals and Businesses

- 3.4 Navigating Bank Holidays: Tips for Financial Success in 2025

- 3.5 Frequently Asked Questions about Bank Holidays in 2025

- 3.6 Conclusion: Embracing Financial Awareness in the Face of Bank Holidays

- 4 Closure

Navigating Financial Life: Understanding the Significance of Bank Holidays in 2025

The year 2025 is rapidly approaching, and with it comes the need to plan for potential disruptions to financial services due to bank holidays. These designated days, observed by banks and financial institutions, can impact a wide range of transactions, from check clearing to loan payments.

This comprehensive guide aims to illuminate the importance of understanding bank holidays in 2025, providing a detailed overview of their impact on individual and business finances.

Understanding Bank Holidays: A Crucial Element of Financial Planning

Bank holidays, also known as banking holidays, are non-working days declared by governments or financial institutions. These days are typically observed to commemorate national events, religious festivals, or provide employees with time off.

While these days are meant for rest and celebration, they can significantly impact financial transactions. Banks and financial institutions generally remain closed on these days, meaning:

- Branch closures: Physical bank branches are typically closed, limiting access to in-person services like account inquiries, deposits, and withdrawals.

- Transaction delays: Electronic transactions, such as wire transfers, ACH payments, and check processing, may experience delays.

- Market closures: Stock exchanges and other financial markets may operate on a reduced schedule or remain closed entirely.

Key Factors Influencing Bank Holidays in 2025

Several factors contribute to the determination of bank holidays in any given year, including:

- National holidays: Each country has its own set of national holidays observed by banks and financial institutions. These holidays are usually established by law and may vary from year to year.

- Religious festivals: Many religious festivals are observed as bank holidays, especially in countries with diverse religious populations. These festivals can be fixed or movable dates, depending on the lunar or solar calendar.

- Regional holidays: Some regions within a country may observe additional holidays not recognized nationally. These regional holidays are often specific to local traditions or cultural events.

- Bank-specific holidays: Individual banks may declare additional holidays based on their internal policies or operational requirements.

The Impact of Bank Holidays on Individuals and Businesses

Bank holidays can have a significant impact on both individuals and businesses, affecting their financial activities and operations.

For Individuals:

- Delayed payments: Paychecks, bill payments, and other financial transactions may be delayed due to bank closures. This can lead to late payment fees or missed deadlines.

- Limited access to funds: Individuals may face difficulties accessing their funds during bank holidays, especially if they rely on cash transactions or need to make urgent payments.

- Disrupted financial planning: Planning for major financial transactions, like buying a house or investing, may be affected by bank closures, requiring adjustments to timelines.

For Businesses:

- Interrupted operations: Businesses may experience disruptions in their operations due to bank closures, affecting financial transactions, payroll processing, and customer service.

- Delayed payments and collections: Payments from clients and suppliers may be delayed, leading to cash flow issues and potential financial strain.

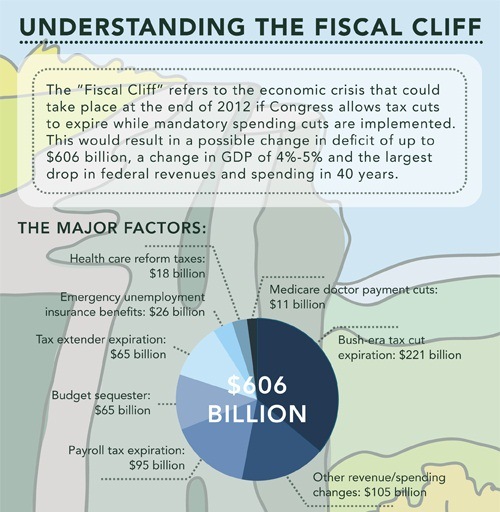

- Market volatility: Stock market closures or reduced trading hours during bank holidays can create volatility and impact investment strategies.

Navigating Bank Holidays: Tips for Financial Success in 2025

Understanding and planning for bank holidays is crucial for maintaining financial stability and avoiding potential disruptions. Here are some practical tips:

- Stay informed: Consult bank websites and financial news sources for updated information about bank holidays in 2025, including specific dates and potential service disruptions.

- Plan ahead: Schedule important financial transactions, such as bill payments and loan applications, well in advance of any bank holidays to avoid delays.

- Consider alternative banking options: Explore online banking options or use mobile banking apps to access your accounts and perform transactions even during bank closures.

- Communicate with clients and suppliers: Inform clients and suppliers about potential delays related to bank holidays to manage expectations and ensure smooth operations.

- Review financial commitments: Ensure that all bills, loan payments, and other financial obligations are scheduled before any bank holidays to avoid late payment fees.

Frequently Asked Questions about Bank Holidays in 2025

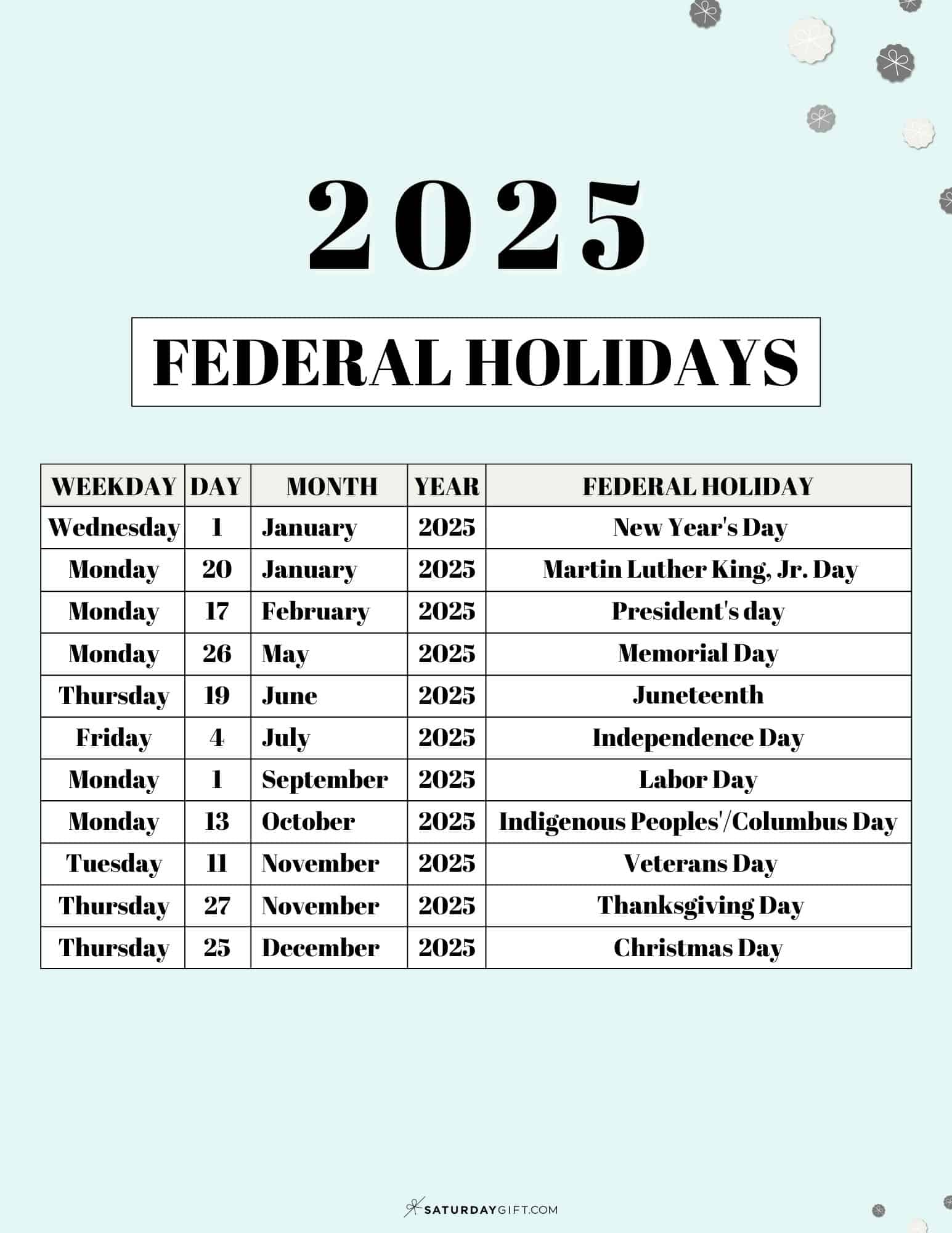

Q: What are the specific bank holidays in 2025?

A: The specific bank holidays in 2025 vary depending on the country and region. It’s crucial to consult official bank websites or financial news sources for accurate information.

Q: How do I check if a specific date is a bank holiday?

A: Most banks and financial institutions publish their holiday calendars online. You can also check with your local bank or financial institution for specific information.

Q: What happens to my automatic payments during a bank holiday?

A: Automatic payments may be delayed during bank holidays. It’s advisable to schedule payments a few days in advance to ensure timely processing.

Q: Can I still access my money during a bank holiday?

A: While bank branches may be closed, you may still be able to access your money through ATMs, online banking, or mobile banking apps.

Q: How do bank holidays impact stock market trading?

A: Stock markets may operate on a reduced schedule or remain closed entirely during bank holidays. It’s important to check the trading schedule before making any investment decisions.

Conclusion: Embracing Financial Awareness in the Face of Bank Holidays

Understanding the impact of bank holidays on financial transactions is essential for both individuals and businesses. By staying informed, planning ahead, and utilizing available resources, it is possible to navigate these periods with minimal disruption and maintain financial stability.

As we move into 2025, embracing financial awareness and taking proactive steps to account for bank holidays will contribute to a smoother and more successful financial experience.

Closure

Thus, we hope this article has provided valuable insights into Navigating Financial Life: Understanding the Significance of Bank Holidays in 2025. We thank you for taking the time to read this article. See you in our next article!