Navigating the Calendar: Understanding and Utilizing Paid Day Number Calendars

Related Articles: Navigating the Calendar: Understanding and Utilizing Paid Day Number Calendars

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Calendar: Understanding and Utilizing Paid Day Number Calendars. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Calendar: Understanding and Utilizing Paid Day Number Calendars

In the intricate world of financial planning and personal budgeting, understanding the nuances of payroll cycles and the corresponding payment dates is crucial. This is where the concept of a paid day number calendar emerges as a powerful tool, providing clarity and structure to the often complex rhythm of income flow.

Decoding the Paid Day Number Calendar: A Fundamental Understanding

At its core, a paid day number calendar is a visual representation of the specific day of the month when an individual or organization receives their salary or wages. This calendar assigns a numerical value to each day of the month, representing the corresponding payment day. For instance, if your payday falls on the 15th of every month, the calendar would depict the 15th with a specific marker or designation, indicating your payment date.

Benefits of Utilizing a Paid Day Number Calendar

The benefits of employing a paid day number calendar extend far beyond mere visual convenience. It serves as a cornerstone for:

- Enhanced Financial Planning: By clearly visualizing your income flow, you gain a strong foundation for constructing a comprehensive budget. This allows for accurate forecasting of income and expenditure, fostering financial stability and reducing the risk of unexpected financial strain.

- Improved Debt Management: Understanding your payday cycle empowers you to effectively manage debt repayment. By aligning repayment deadlines with your income dates, you can ensure timely payments and avoid late fees or penalties.

- Streamlined Savings Strategies: With a clear picture of your income schedule, you can effectively plan and execute savings goals. This could involve setting aside specific amounts on each payday, contributing to retirement funds, or building an emergency savings fund.

- Enhanced Investment Decisions: The knowledge of your consistent income flow enables informed investment decisions. You can allocate funds for specific investment opportunities based on your predictable income stream, maximizing returns and minimizing risk.

- Increased Financial Awareness: Utilizing a paid day number calendar fosters a heightened awareness of your financial situation. It encourages regular monitoring of your income and expenses, promoting responsible financial behavior and informed decision-making.

Types of Paid Day Number Calendars

While the fundamental concept remains constant, paid day number calendars can be tailored to specific needs and preferences. Here are some common variations:

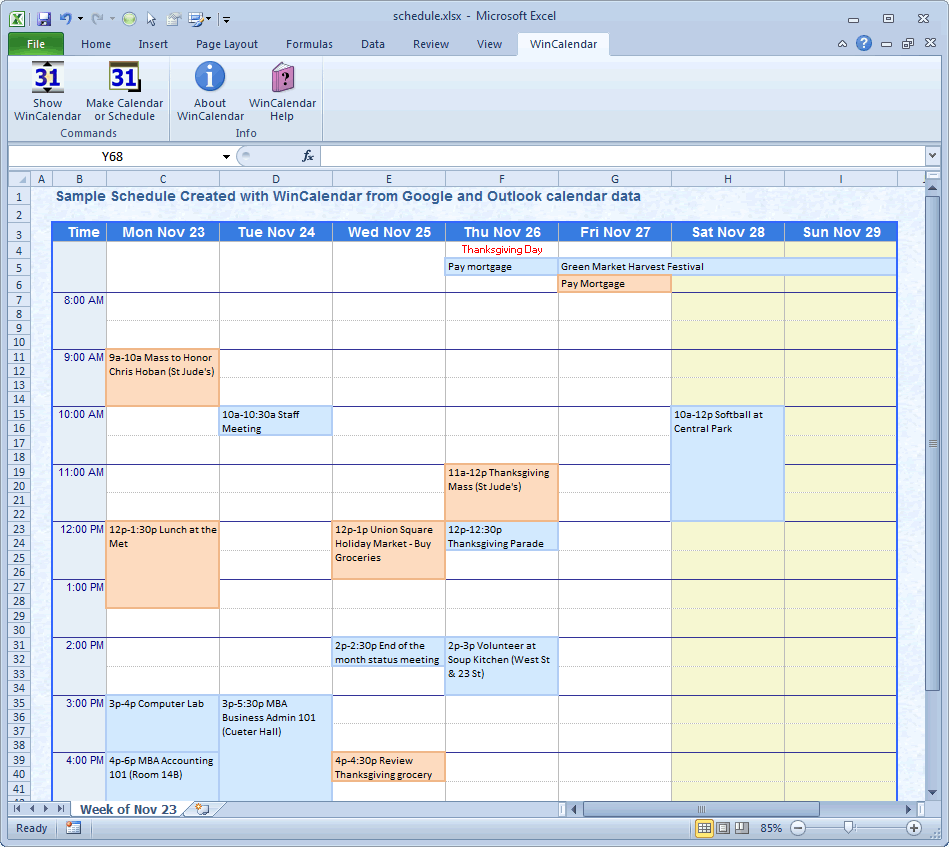

- Standard Monthly Calendar: This format typically displays a traditional calendar grid with each day of the month clearly marked. The designated payday is highlighted with a specific color, symbol, or notation.

- Pay Cycle Calendar: This type focuses on the specific pay cycle, often representing a bi-weekly or semi-monthly payment schedule. It visually depicts the payment dates within a specific cycle, enhancing clarity for recurring income.

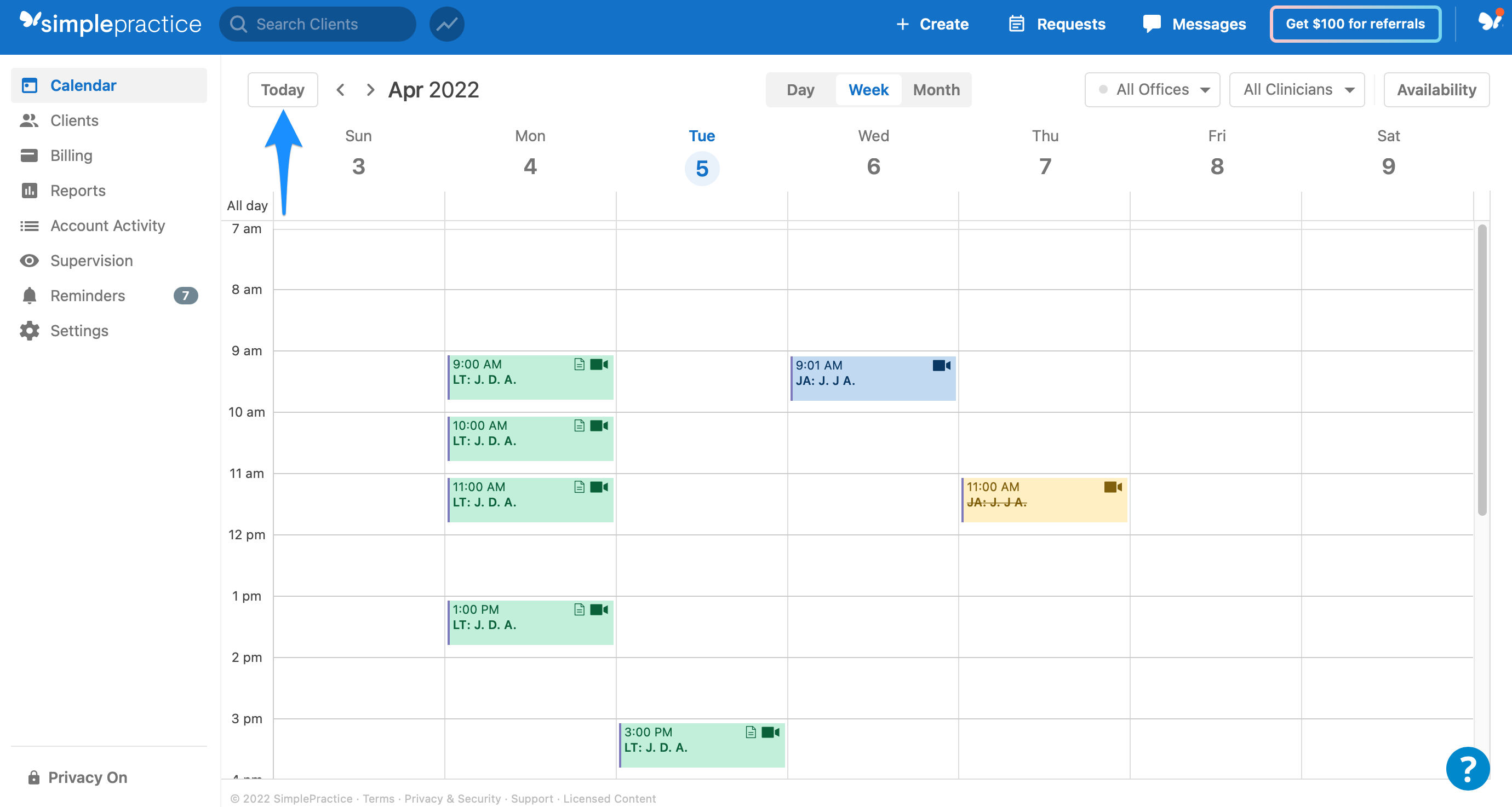

- Interactive Online Calendars: These digital tools provide a more dynamic and interactive approach. Users can input their specific payday and view a calendar that automatically highlights their payment dates, often offering additional features like budget tracking or expense management.

Creating Your Own Paid Day Number Calendar

While readily available online and in various formats, creating your own paid day number calendar can be a valuable exercise in financial literacy. This simple process involves:

- Identifying Your Payday: Determine the specific day of the month when you receive your income.

- Selecting a Calendar Format: Choose a calendar format that suits your preferences, whether it’s a traditional printed calendar, a digital spreadsheet, or a specialized online tool.

- Marking Your Payday: Clearly highlight your designated payday on the chosen calendar format using a distinctive color, symbol, or notation.

FAQs Regarding Paid Day Number Calendars

1. What if my payday varies from month to month?

For fluctuating payment schedules, it’s advisable to use a calendar format that allows for flexibility. Consider a digital spreadsheet or online tool where you can manually adjust your payday for each month.

2. How can I use a paid day number calendar for budgeting purposes?

Integrate your calendar with your budgeting tools. Mark your income dates and use them as a guide for allocating funds for expenses, debt repayment, and savings goals.

3. Are there any limitations to using a paid day number calendar?

While highly beneficial, the calendar relies on a consistent income flow. Fluctuations in income, such as bonuses or unexpected expenses, may require adjustments and careful planning.

4. Can I use a paid day number calendar for multiple income sources?

Absolutely. You can incorporate multiple paydays on the calendar, clearly distinguishing them with different colors or symbols.

5. Is a paid day number calendar suitable for everyone?

This tool is particularly beneficial for individuals who rely on a regular income flow for financial planning and budgeting. It may be less relevant for those with fluctuating income or who prefer alternative methods for managing finances.

Tips for Effective Utilization of Paid Day Number Calendars

- Regularly Update: Ensure your calendar reflects any changes to your payday or payment schedule.

- Integrate with Budgeting Tools: Combine your calendar with your budgeting software or spreadsheets for comprehensive financial management.

- Visualize Financial Goals: Utilize the calendar to visualize your financial goals, such as saving for a down payment or paying off debt.

- Share with Family Members: Involve family members in understanding the calendar, fostering shared financial awareness and collaboration.

- Adapt to Your Needs: Customize the calendar to meet your specific needs and preferences, whether it’s a simple paper calendar or a sophisticated online tool.

Conclusion: Embracing Financial Clarity and Control

The paid day number calendar serves as a powerful tool for navigating the complexities of income flow and financial planning. By providing a visual representation of your payment schedule, it empowers you to effectively manage your finances, optimize your budgeting strategies, and confidently achieve your financial goals. Embrace the clarity and control that a paid day number calendar offers, setting yourself on a path towards financial stability and well-being.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Calendar: Understanding and Utilizing Paid Day Number Calendars. We thank you for taking the time to read this article. See you in our next article!