Navigating the Landscape of Dividend Announcements: A Comprehensive Guide

Related Articles: Navigating the Landscape of Dividend Announcements: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Landscape of Dividend Announcements: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of Dividend Announcements: A Comprehensive Guide

The world of investing is filled with intricate details and crucial information that can significantly impact portfolio performance. Among these, dividend announcements stand out as a significant event for both individual and institutional investors. Understanding the timing and nuances of these announcements is essential for making informed investment decisions. This comprehensive guide delves into the intricacies of dividend announcements, their impact on the market, and the tools available for staying informed.

Understanding the Importance of Dividend Announcements

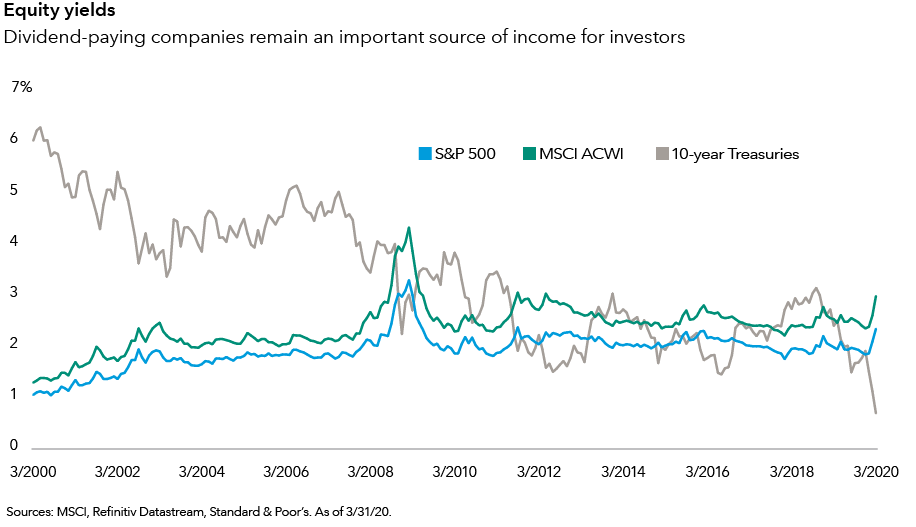

Dividends represent a portion of a company’s profits distributed to shareholders. These payments are a key factor in attracting investors, particularly those seeking steady income streams. When a company announces a dividend, it signals its financial health, profitability, and commitment to shareholder value. The announcement itself can influence stock prices, investor sentiment, and overall market trends.

Key Elements of Dividend Announcements

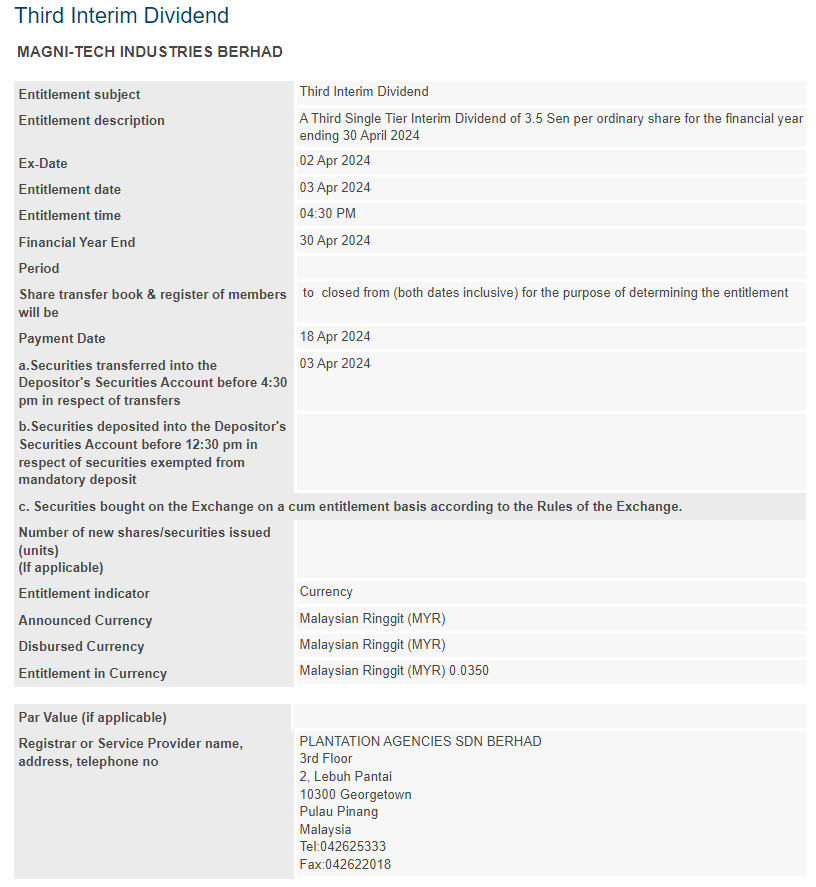

A typical dividend announcement includes the following crucial elements:

- Declaration Date: This marks the official announcement of the dividend by the company’s board of directors. It sets the record date and payment date.

- Record Date: Investors who hold shares on this date are eligible to receive the dividend payment.

- Ex-Dividend Date: This date is typically two business days before the record date. Investors who purchase shares on or after this date are not eligible for the dividend.

- Payment Date: This is the date when the dividend payment is distributed to eligible shareholders.

- Dividend Amount: The amount of the dividend payment per share, typically expressed in currency units.

Types of Dividends

Companies can declare different types of dividends, each with its own characteristics:

- Regular Dividends: These are recurring payments made at regular intervals, often quarterly or annually. They are a cornerstone of dividend-paying companies, providing consistent income for investors.

- Special Dividends: These are one-time payments made in addition to regular dividends. They often indicate a company’s strong financial performance or a specific event, such as a major asset sale.

- Stock Dividends: Instead of cash, companies may issue additional shares of stock to shareholders. This can dilute the value of existing shares but increase the total number of shares held.

- Dividend Reinvestment Plans (DRIPs): These plans allow shareholders to automatically reinvest their dividends in additional shares of the company. This can help build a larger position over time.

The Impact of Dividend Announcements on the Market

Dividend announcements can significantly impact the market in various ways:

- Stock Price Fluctuations: Announcements of increased dividends or special dividends often lead to a rise in stock prices. Conversely, cuts or cancellations of dividends can result in price declines.

- Investor Sentiment: Positive dividend announcements can boost investor confidence and attract new capital to the company. Conversely, negative announcements can erode investor trust and lead to selling pressure.

- Sector Performance: Dividend announcements can impact the performance of entire sectors. For instance, a major oil company announcing a dividend increase could positively affect the energy sector.

Utilizing Dividend Announcements for Investment Strategies

Dividend announcements can be a valuable tool for investors seeking to maximize returns and manage risk. Here’s how they can be used:

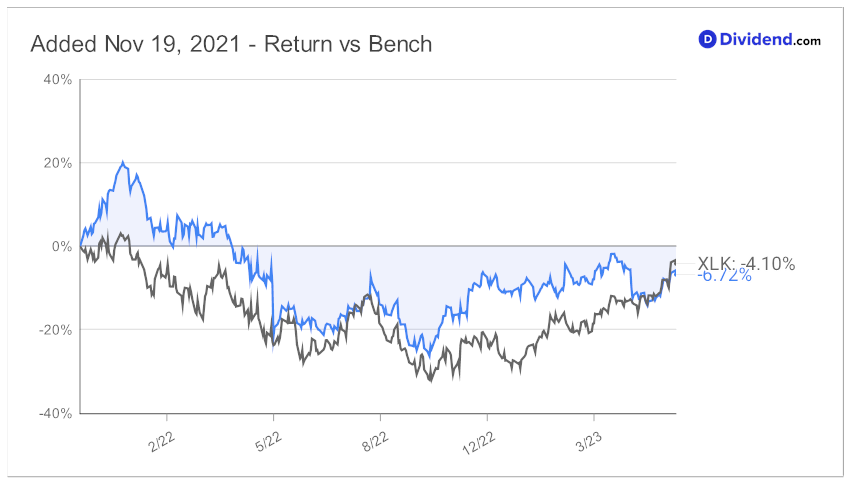

- Income Generation: Investors looking for stable income streams can focus on companies with a history of consistent dividend payments.

- Growth Potential: Companies with a strong track record of dividend increases often demonstrate robust growth and profitability.

- Risk Management: Monitoring dividend announcements can help identify potential warning signs of financial distress or declining profitability.

Tools and Resources for Tracking Dividend Announcements

Staying informed about dividend announcements is crucial for making informed investment decisions. Various tools and resources can help investors track this information:

- Financial News Websites: Websites like Bloomberg, Reuters, and Yahoo Finance provide comprehensive coverage of dividend announcements.

- Brokerage Platforms: Most online brokerage platforms offer tools for tracking dividend announcements and other financial events.

- Dividend Calendar Websites: Dedicated websites like Dividend.com and Simply Wall St. provide comprehensive dividend calendars that list upcoming announcements.

- Financial Newsletters: Subscription-based newsletters can provide in-depth analysis of dividend announcements and their implications.

FAQs about Dividend Announcements

1. What is the difference between the ex-dividend date and the record date?

The ex-dividend date is the last day you can buy a stock and still receive the dividend. The record date is the date the company uses to determine which shareholders are eligible to receive the dividend.

2. Why do some companies pay dividends while others don’t?

Companies may choose to pay dividends based on factors such as profitability, growth prospects, and debt levels. Companies with mature businesses and stable earnings are more likely to pay dividends.

3. How can I find out if a company is going to announce a dividend?

You can track dividend announcements through financial news websites, brokerage platforms, and dividend calendar websites.

4. What happens if a company cuts or cancels its dividend?

A dividend cut or cancellation can signal financial distress and often leads to a decline in stock price.

5. What are the tax implications of dividends?

Dividends are typically taxed as ordinary income, although some dividends may qualify for preferential tax rates.

Tips for Utilizing Dividend Announcements

- Focus on companies with a history of consistent dividend payments.

- Consider dividend growth potential when making investment decisions.

- Monitor dividend announcements for potential warning signs of financial distress.

- Utilize dividend calendar websites and other tools to stay informed.

- Consult with a financial advisor for personalized guidance on dividend investing.

Conclusion

Dividend announcements play a significant role in the investment landscape, providing valuable insights into companies’ financial health and future prospects. By understanding the intricacies of these announcements, investors can make informed decisions, optimize their portfolios, and navigate the market with greater confidence. Staying informed about dividend announcements, leveraging available tools and resources, and employing sound investment strategies can lead to a more rewarding and successful investment journey.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of Dividend Announcements: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!