Navigating the Tax Refund Landscape: Understanding the 2025 Filing Season

Related Articles: Navigating the Tax Refund Landscape: Understanding the 2025 Filing Season

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Tax Refund Landscape: Understanding the 2025 Filing Season. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Tax Refund Landscape: Understanding the 2025 Filing Season

The annual tax season is a period of anticipation for many, particularly when it comes to potential tax refunds. While the Internal Revenue Service (IRS) diligently processes returns, the timing of refund issuance can vary significantly. This variance stems from factors such as the complexity of the return, the accuracy of the information provided, and the volume of filings received.

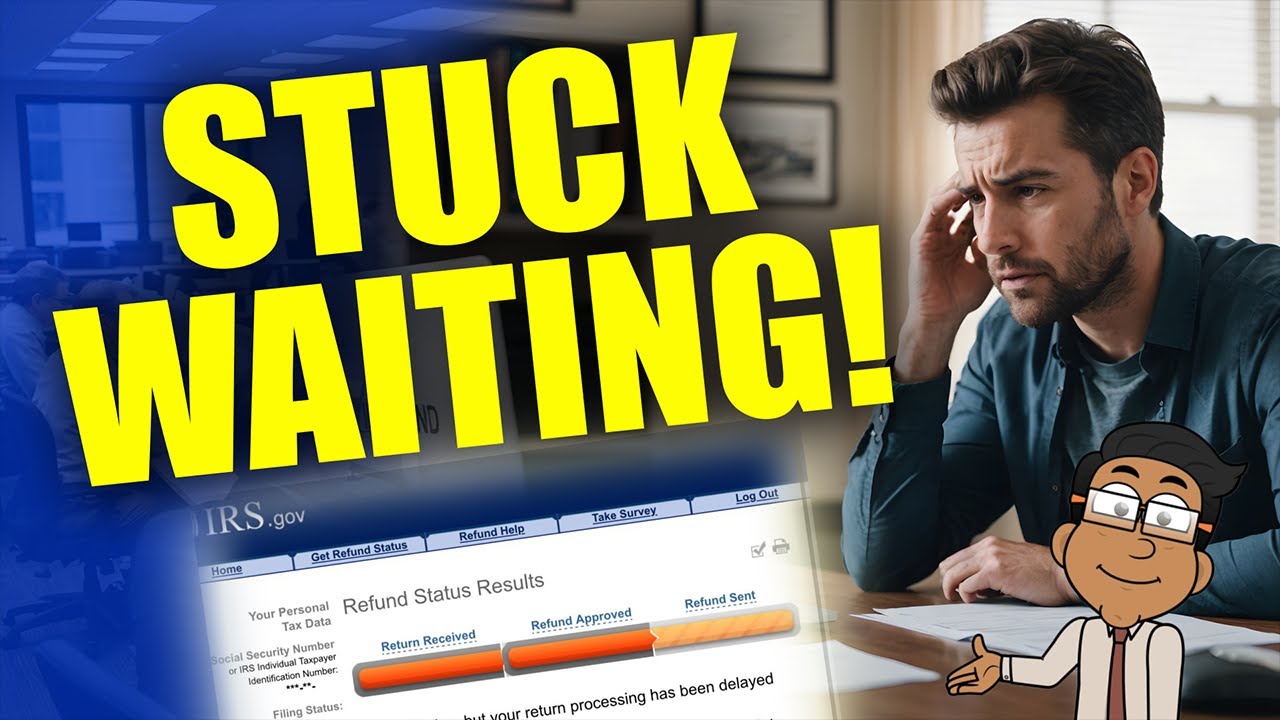

To provide taxpayers with a clearer picture of the refund processing timeline, the IRS utilizes a tool known as the "Where’s My Refund?" tracker. This online resource offers real-time updates on the status of a filed tax return, allowing individuals to monitor the progress of their refund.

Understanding the "Where’s My Refund?" Tracker

The "Where’s My Refund?" tool is a valuable resource for taxpayers seeking information about their tax refund. It provides a convenient and transparent platform for monitoring the refund process. Here’s how it works:

- Access: The tool is accessible through the IRS website or the IRS2Go mobile app.

- Information Required: To access your refund status, you’ll need your Social Security number, filing status, and the exact amount of your refund.

- Real-Time Updates: The tool provides updated information on the status of your refund, indicating whether it has been received, processed, or issued.

- Timeline Estimates: The tool offers estimated timelines for refund issuance based on the information provided.

Factors Affecting Refund Processing Timelines

While the "Where’s My Refund?" tool offers valuable insights, it’s essential to understand that refund processing timelines can be influenced by several factors:

- Filing Method: Electronic filing generally leads to faster processing times compared to paper filing.

- Accuracy of Information: Errors or omissions in the tax return can result in delays in processing.

- Completeness of Information: Ensure all necessary documentation, such as W-2 forms, is included with the return.

- Tax Law Complexity: Complex tax situations involving deductions, credits, or special circumstances may require additional review.

- IRS Workload: The IRS experiences a surge in filings during peak tax season, potentially leading to delays in processing.

- Fraud Prevention Measures: The IRS employs robust fraud prevention measures, which can occasionally lead to delays in processing returns.

Tips for Ensuring Timely Refund Processing

To maximize the chances of receiving a timely refund, consider these tips:

- File Electronically: Electronic filing offers the quickest route to processing.

- Double-Check Information: Ensure all information on the tax return is accurate and complete.

- File Early: Filing early in the tax season can help avoid potential delays associated with peak workload periods.

- Track Your Refund: Utilize the "Where’s My Refund?" tool to stay informed about the status of your refund.

- Contact the IRS: If you have concerns about your refund status or encounter any difficulties, contact the IRS for assistance.

Frequently Asked Questions (FAQs)

Q: When is the tax filing deadline for 2025?

A: The tax filing deadline for 2025 will likely be April 15, 2026. However, it’s crucial to check for any potential changes or extensions announced by the IRS.

Q: Can I track my refund using the "Where’s My Refund?" tool before filing?

A: No, the "Where’s My Refund?" tool can only be used to track refunds after a tax return has been filed.

Q: What if the "Where’s My Refund?" tool shows no information about my refund?

A: If the tool does not display any information about your refund, it may indicate that the IRS has not yet received your return. It’s recommended to check the status again in a few days.

Q: My refund status shows "Processing" for several weeks. Should I be concerned?

A: While the "Processing" status may indicate a longer processing time, it’s not necessarily a cause for concern. The IRS processes millions of returns annually, and some may take longer than others. Continue monitoring your refund status through the tool.

Q: What should I do if I receive a notice from the IRS about my return?

A: If you receive a notice from the IRS, it’s crucial to respond promptly. The notice may require additional information or clarification regarding your return. Failure to respond could result in delays or penalties.

Q: Can I use the "Where’s My Refund?" tool to track the status of a tax payment?

A: No, the "Where’s My Refund?" tool is specifically designed to track the status of tax refunds. It does not provide information about tax payments.

Conclusion

The "Where’s My Refund?" tool offers taxpayers a valuable resource for monitoring the status of their tax refund. By understanding the factors that can influence processing timelines and utilizing the tool effectively, individuals can gain a clearer picture of the refund process and stay informed about their refund status. While the IRS strives to process returns efficiently, occasional delays are inevitable. Patience and proactive communication with the IRS are key to navigating the tax refund landscape.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Tax Refund Landscape: Understanding the 2025 Filing Season. We appreciate your attention to our article. See you in our next article!