Navigating Your Finances: A Comprehensive Guide to the 2025 Pay Date Calendar

Related Articles: Navigating Your Finances: A Comprehensive Guide to the 2025 Pay Date Calendar

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating Your Finances: A Comprehensive Guide to the 2025 Pay Date Calendar. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating Your Finances: A Comprehensive Guide to the 2025 Pay Date Calendar

- 2 Introduction

- 3 Navigating Your Finances: A Comprehensive Guide to the 2025 Pay Date Calendar

- 3.1 The Significance of a Pay Date Calendar

- 3.2 Creating Your 2025 Pay Date Calendar

- 3.3 Utilizing Your 2025 Pay Date Calendar

- 3.4 Frequently Asked Questions (FAQs)

- 3.5 Conclusion

- 4 Closure

Navigating Your Finances: A Comprehensive Guide to the 2025 Pay Date Calendar

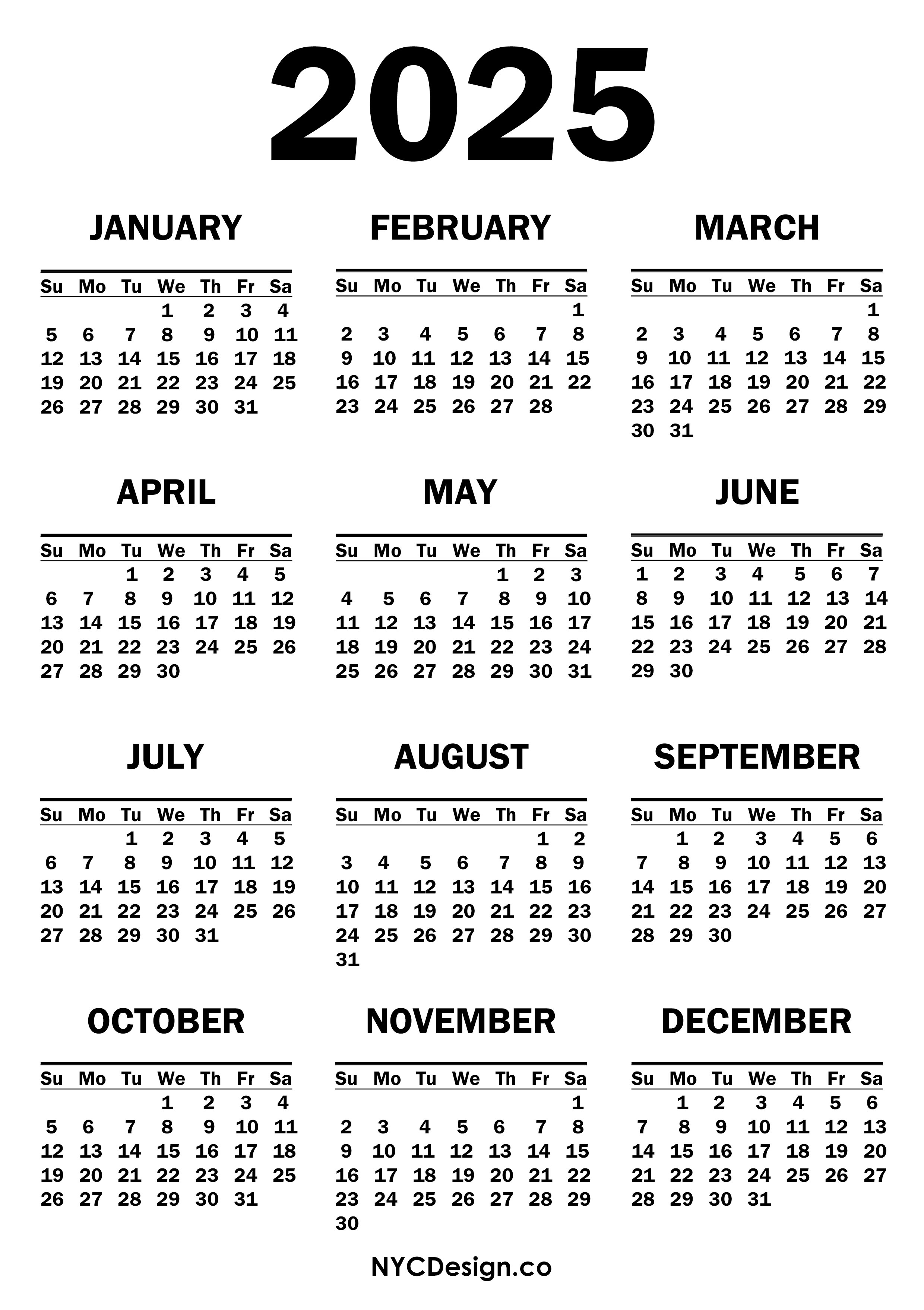

Understanding when you will receive your paycheck is crucial for effective financial planning. A pay date calendar, a tool that outlines your anticipated paydays throughout the year, serves as a vital guide for managing your finances responsibly. This guide delves into the significance of a 2025 pay date calendar, exploring its benefits and providing practical tips for its utilization.

The Significance of a Pay Date Calendar

A pay date calendar offers numerous benefits for individuals and businesses alike, fostering financial stability and promoting informed decision-making.

For Individuals:

- Budgeting and Financial Planning: A pay date calendar serves as a foundational element for creating a comprehensive budget. By knowing your income stream, you can accurately allocate funds for essential expenses, savings goals, and discretionary spending. This structured approach prevents overspending and promotes financial stability.

- Debt Management: A clear understanding of your income flow facilitates efficient debt management. Knowing when your paycheck arrives allows you to prioritize debt repayment, ensuring timely payments and minimizing interest charges.

- Saving and Investment Goals: A pay date calendar empowers you to plan for your financial future. By identifying your income dates, you can establish regular savings contributions or investment strategies, aligning your actions with your long-term financial aspirations.

- Avoiding Overdraft Fees: A pay date calendar helps you avoid the pitfalls of overdraft fees by providing a clear picture of when your income arrives. This awareness allows you to manage your spending and ensure sufficient funds in your account.

- Meeting Financial Obligations: A pay date calendar serves as a reminder of important financial obligations, such as rent, mortgage payments, and utility bills. By aligning these payments with your income dates, you can avoid late fees and maintain a positive credit score.

For Businesses:

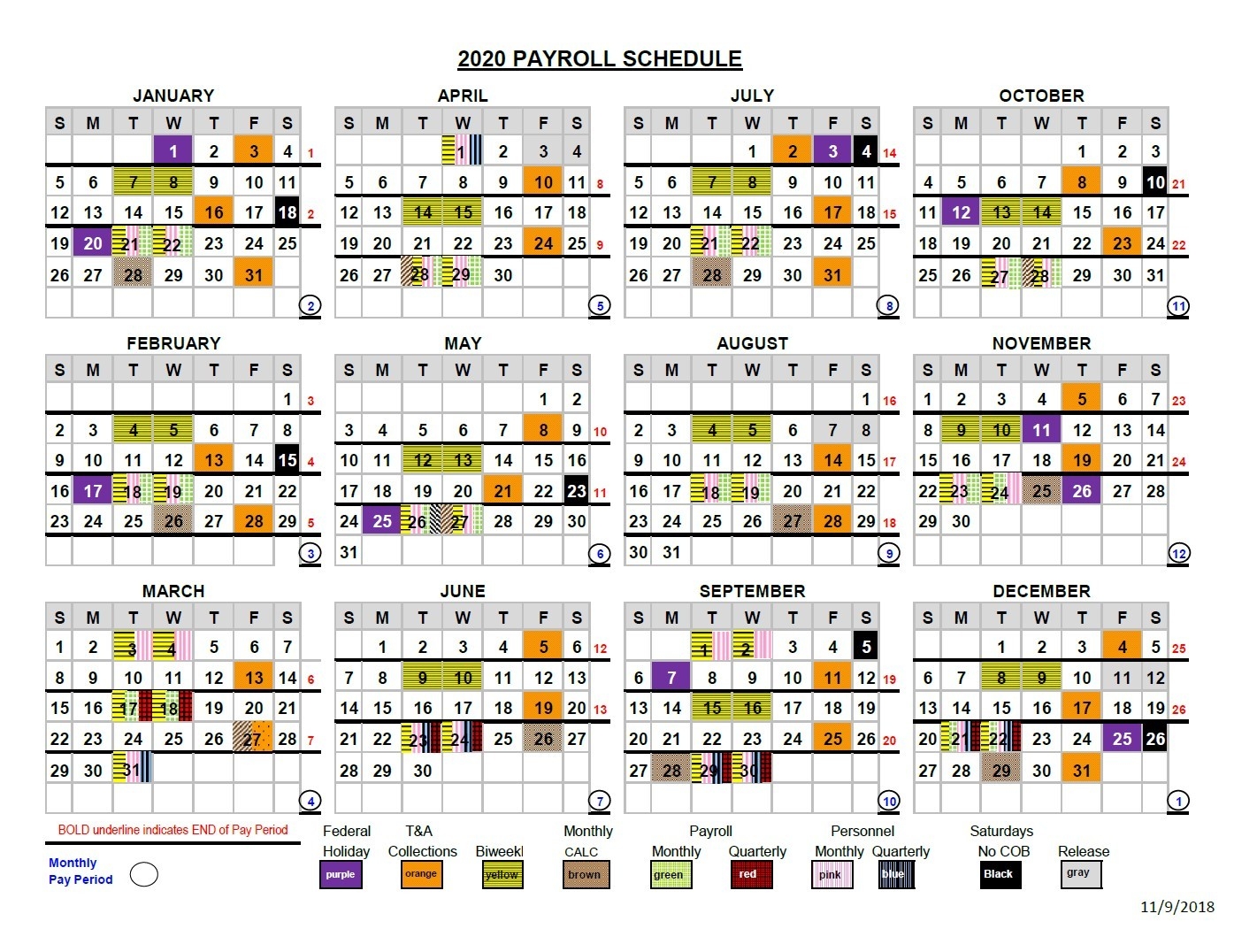

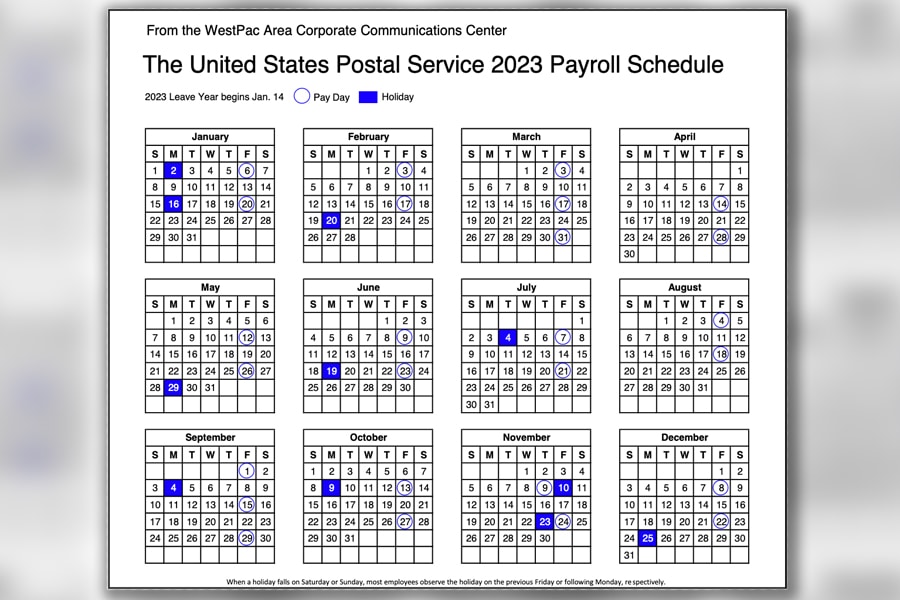

- Payroll Management: A pay date calendar simplifies payroll management, ensuring timely and accurate payroll processing. This streamlined process minimizes administrative burdens and fosters employee satisfaction.

- Cash Flow Forecasting: A pay date calendar assists businesses in forecasting cash flow, allowing them to anticipate income and expenditure patterns. This data aids in financial planning, budgeting, and investment decisions.

- Inventory Management: For businesses with cyclical sales patterns, a pay date calendar helps align inventory management with anticipated income peaks and troughs. This strategy ensures sufficient stock availability during high-demand periods while minimizing overstocking.

- Financial Reporting: A pay date calendar provides valuable data for financial reporting, enabling businesses to track income and expenditure trends over time. This information supports informed decision-making and long-term financial planning.

Creating Your 2025 Pay Date Calendar

While some employers provide pay date calendars, others do not. Here are some steps to create your own:

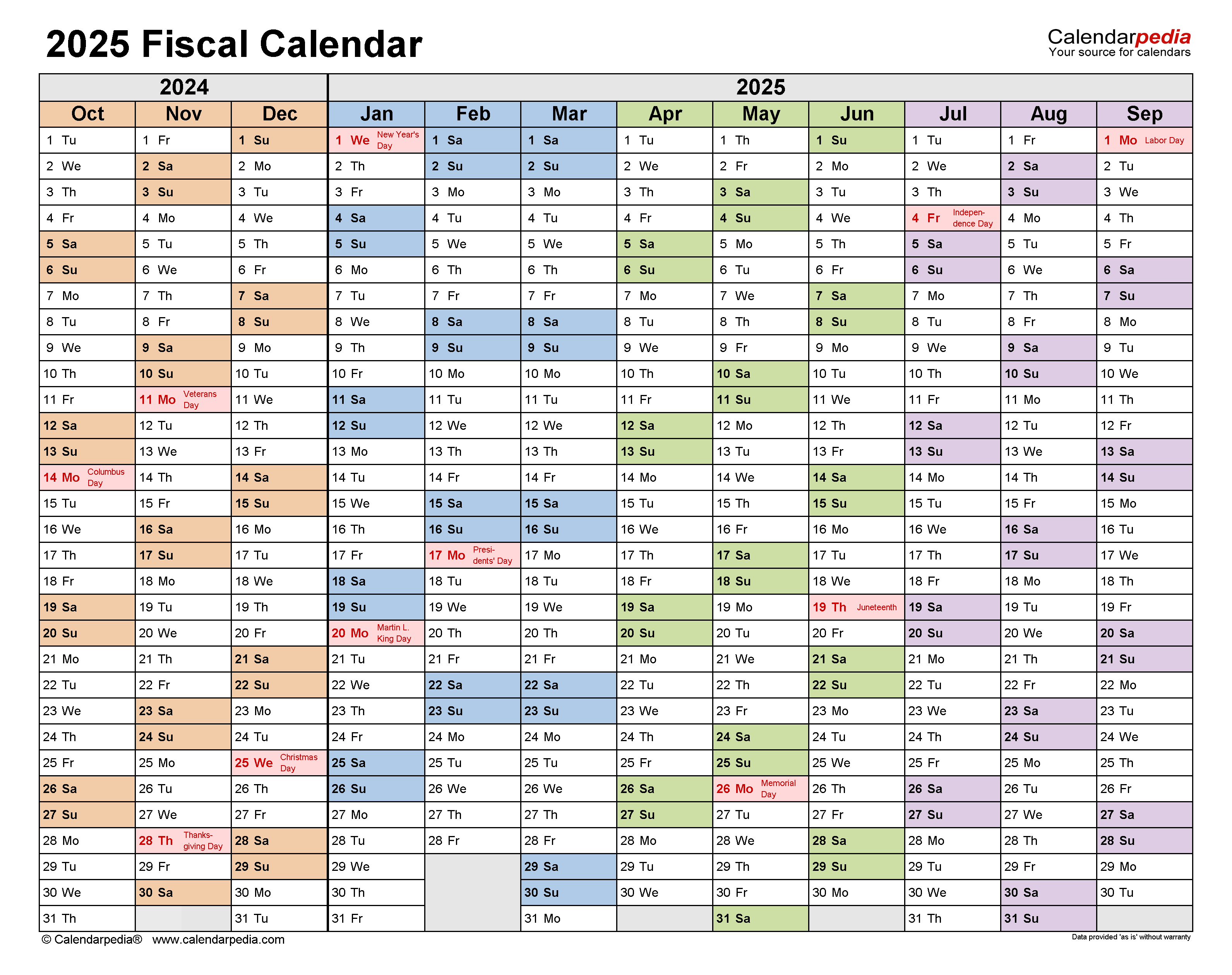

- Determine Your Pay Frequency: Identify your pay frequency, whether weekly, bi-weekly, semi-monthly, or monthly.

- Identify Your Payday: Confirm the specific day of the week or month when you typically receive your paycheck.

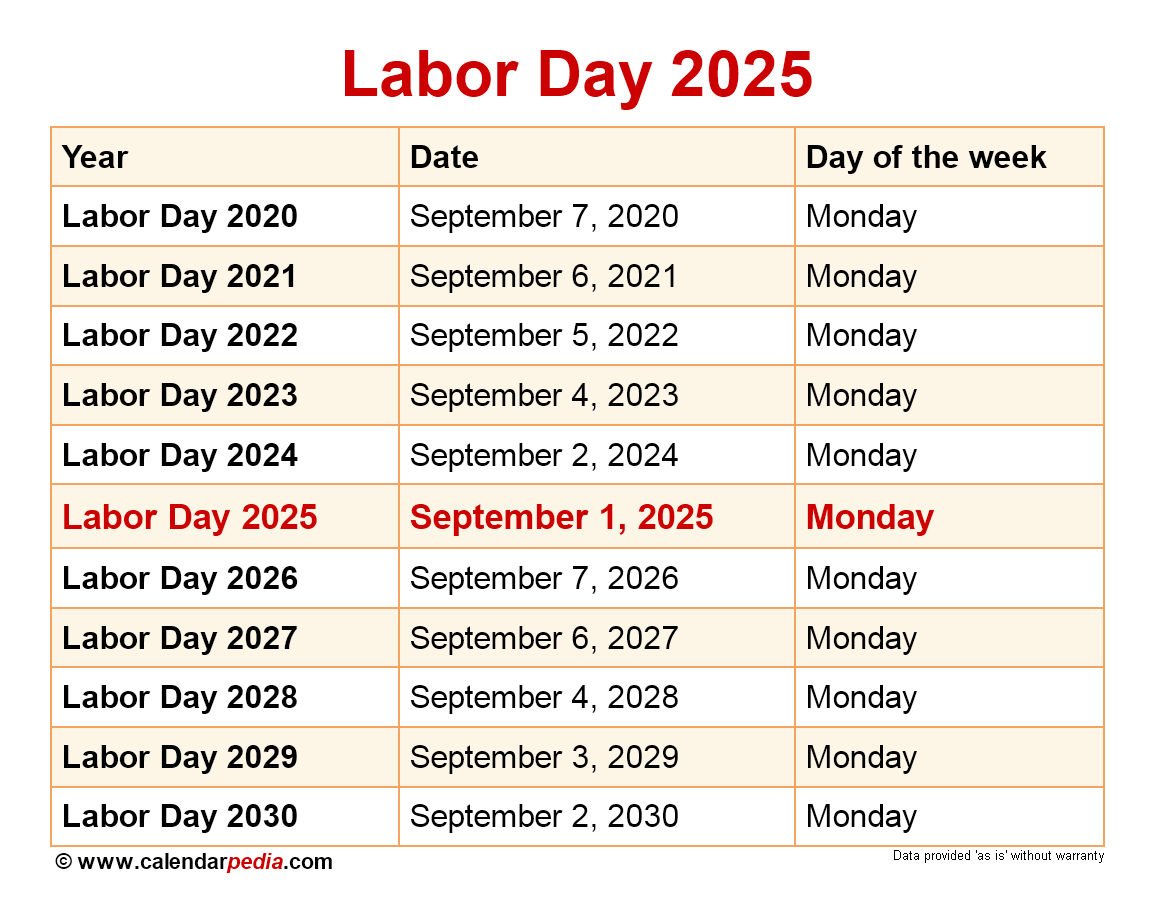

- Consider Holiday Impacts: Factor in holidays that might affect your pay date. Some employers adjust paydays to accommodate holidays, potentially shifting your income schedule.

- Account for Irregularities: If your pay date is subject to variations due to company policies or unforeseen circumstances, note these exceptions on your calendar.

Utilizing Your 2025 Pay Date Calendar

Once you have created your pay date calendar, it is essential to use it effectively. Here are some tips:

- Mark Important Dates: Highlight significant financial obligations on your calendar, such as rent, mortgage payments, utility bills, loan repayments, and credit card payments.

- Schedule Savings Contributions: Allocate specific dates on your calendar for making regular savings contributions, aligning them with your income dates.

- Track Spending: Use your calendar to track your spending habits, noting when you make major purchases or incur unexpected expenses. This practice helps you identify areas for potential savings.

- Review Regularly: Periodically review your calendar, adjusting it as needed to reflect any changes in your pay frequency, pay dates, or financial obligations.

Frequently Asked Questions (FAQs)

1. What if my pay date falls on a weekend or holiday?

Some employers adjust pay dates to accommodate weekends and holidays. Check with your employer for their specific policy regarding pay dates that fall on non-working days.

2. Can I change my pay date?

You can discuss changing your pay date with your employer, but it is not always possible. Many companies have fixed pay schedules, and changing them might require a formal request or approval process.

3. How can I avoid overdraft fees?

To avoid overdraft fees, ensure you have sufficient funds in your account before making payments or withdrawals. Use your pay date calendar to track your income flow and manage your spending accordingly.

4. How can I create a realistic budget?

To create a realistic budget, track your expenses for a few months, noting your income and expenditure patterns. Use your pay date calendar to align your spending with your income dates, ensuring you have sufficient funds for essential expenses and savings goals.

5. Is it possible to get paid early?

Some employers offer the option of getting paid early, either through a direct deposit or a payroll advance. However, these options often come with fees or interest charges.

Conclusion

A 2025 pay date calendar is an invaluable tool for promoting financial stability and informed decision-making. By understanding your income flow and aligning your financial obligations with your pay dates, you can manage your finances effectively, avoid overspending, and achieve your financial goals. Whether you are an individual seeking to control your finances or a business striving for efficient cash flow management, a pay date calendar provides a roadmap for navigating your financial journey with confidence.

Closure

Thus, we hope this article has provided valuable insights into Navigating Your Finances: A Comprehensive Guide to the 2025 Pay Date Calendar. We hope you find this article informative and beneficial. See you in our next article!