Unveiling the Power of Loan Amortization: A Comprehensive Guide to Financial Clarity

Related Articles: Unveiling the Power of Loan Amortization: A Comprehensive Guide to Financial Clarity

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Unveiling the Power of Loan Amortization: A Comprehensive Guide to Financial Clarity. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unveiling the Power of Loan Amortization: A Comprehensive Guide to Financial Clarity

In the realm of personal finance, understanding the nuances of loan repayment can be a daunting task. The concept of loan amortization, however, provides a powerful tool for navigating this complex landscape. This guide delves into the intricacies of loan amortization, exploring its significance, benefits, and practical applications.

Defining Loan Amortization: A Journey Towards Debt Freedom

Loan amortization refers to the process of gradually paying off a loan over time through a series of regular payments. Each payment comprises both principal and interest, systematically chipping away at the outstanding loan balance. This structured approach ensures a predictable and manageable repayment plan, allowing borrowers to gain control over their debt obligations.

The Mechanics of Amortization: Unveiling the Inner Workings

At the heart of loan amortization lies the amortization schedule, a detailed breakdown of each payment’s allocation between principal and interest. This schedule provides a clear roadmap for the entire repayment journey, outlining the diminishing principal balance and the corresponding interest payments over time.

Factors Influencing Amortization: Understanding the Dynamics

Several factors influence the amortization process, shaping the repayment schedule and ultimately determining the total cost of borrowing. These factors include:

- Loan amount: The initial principal amount borrowed directly impacts the size of each payment and the overall repayment duration.

- Interest rate: The interest rate applied to the loan dictates the cost of borrowing. Higher interest rates result in larger interest payments and a longer repayment period.

- Loan term: The duration of the loan, expressed in years or months, influences the frequency and size of payments. Longer loan terms generally result in smaller payments but accrue more interest over time.

- Payment frequency: The frequency of payments, whether monthly, bi-weekly, or weekly, affects the total number of payments made and the overall repayment period.

Benefits of Loan Amortization: A Pathway to Financial Well-being

The benefits of loan amortization extend beyond merely tracking repayment progress. Understanding and utilizing this framework offers numerous advantages for borrowers:

- Financial clarity: The amortization schedule provides a clear picture of the repayment journey, empowering borrowers to make informed financial decisions and track their progress towards debt freedom.

- Predictability: Regular payments, determined by the amortization schedule, create a predictable financial plan, allowing borrowers to budget effectively and avoid unexpected financial burdens.

- Debt management: Amortization helps borrowers manage their debt obligations efficiently, ensuring timely payments and avoiding late fees or penalties.

- Interest cost reduction: By systematically paying down the principal balance, amortization minimizes the overall interest cost, ultimately saving money over the life of the loan.

- Early repayment flexibility: The amortization schedule provides a framework for early repayment, allowing borrowers to accelerate their debt reduction and potentially save even more on interest.

Utilizing the Amortization Calendar: A Practical Guide

An amortization calendar, a visual representation of the amortization schedule, offers a powerful tool for managing loans effectively. This calendar typically displays:

- Payment date: The date of each scheduled payment.

- Payment amount: The total amount due for each payment.

- Principal payment: The portion of each payment allocated to reducing the principal balance.

- Interest payment: The portion of each payment allocated to interest charges.

- Remaining balance: The outstanding loan balance after each payment.

Creating an Amortization Calendar: A DIY Approach

While numerous online tools and software programs can generate amortization calendars, creating one manually can provide deeper insight into the repayment process. The steps involved include:

- Gather necessary information: Collect the loan amount, interest rate, loan term, and payment frequency.

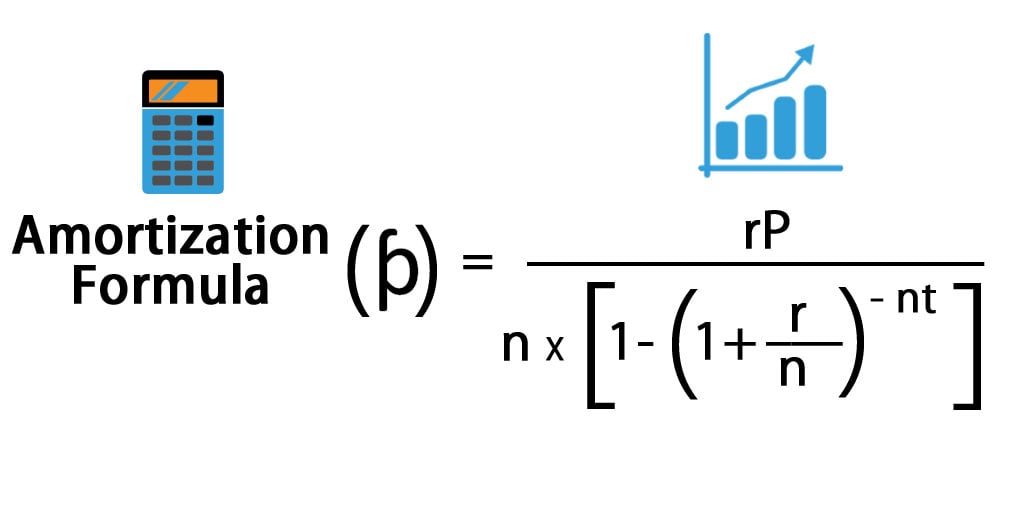

- Calculate the monthly payment: Use an online loan calculator or a formula to determine the monthly payment amount.

- Create a table: Construct a table with columns for payment date, payment amount, principal payment, interest payment, and remaining balance.

- Populate the table: Fill in the table with the calculated payment amounts, allocating the appropriate portions to principal and interest based on the amortization schedule.

Interpreting the Amortization Calendar: Insights into Repayment

The amortization calendar provides a wealth of information, enabling borrowers to:

- Track repayment progress: Visualize the gradual reduction of the principal balance over time.

- Monitor interest payments: Observe the declining interest payments as the principal balance decreases.

- Assess repayment timeline: Estimate the remaining time needed to fully repay the loan.

- Identify potential savings: Evaluate the impact of early repayment on the total interest cost.

FAQs: Addressing Common Questions

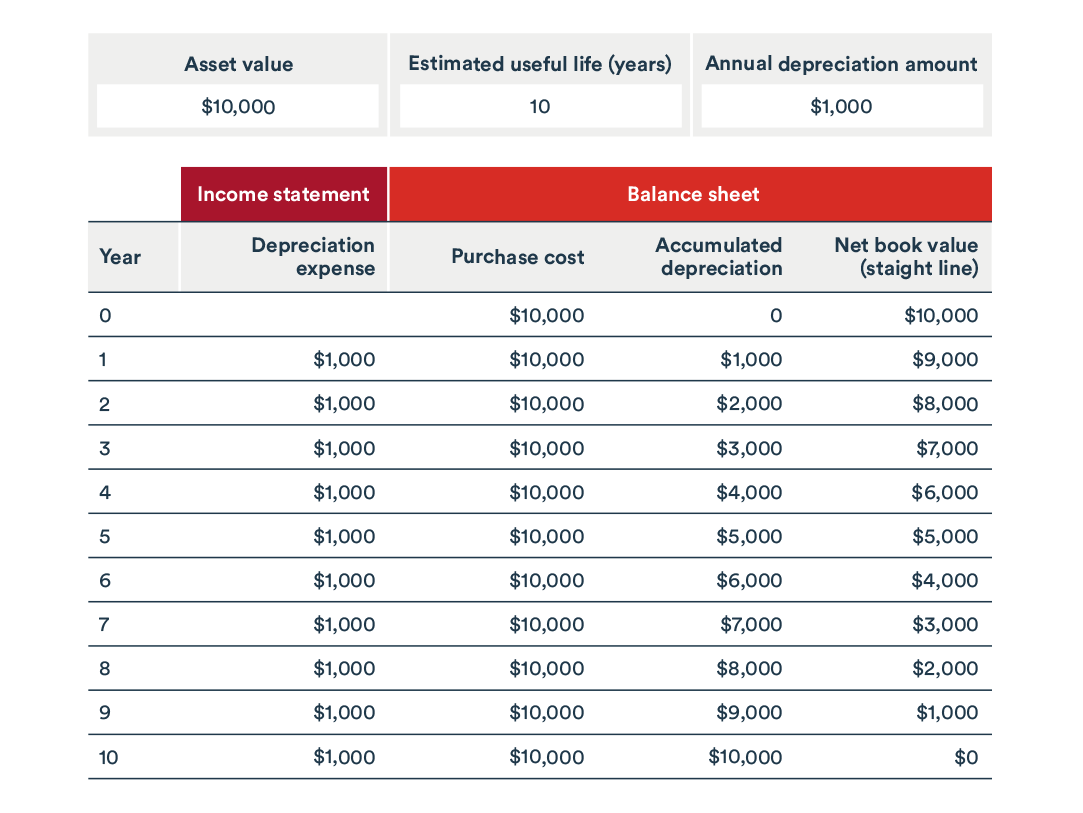

Q: What is the difference between amortization and depreciation?

A: Amortization refers to the gradual repayment of a loan, while depreciation represents the decline in value of an asset over time.

Q: Is amortization only applicable to mortgages?

A: No, amortization applies to various types of loans, including mortgages, auto loans, student loans, and personal loans.

Q: How does prepayment affect amortization?

A: Making prepayments reduces the principal balance, accelerating the amortization process and potentially saving on interest.

Q: Can I change my amortization schedule?

A: Depending on the loan terms, you may be able to modify the amortization schedule by increasing payments or making prepayments.

Q: What happens if I miss a payment?

A: Missing a payment can lead to late fees, penalties, and potentially a change in the amortization schedule.

Tips for Effective Loan Amortization

- Prioritize loan payments: Make loan payments a top financial priority to avoid late fees and maintain a positive credit score.

- Explore prepayment options: Consider making extra payments or lump-sum payments to accelerate debt reduction and save on interest.

- Seek professional advice: Consult with a financial advisor to discuss strategies for managing debt and optimizing loan amortization.

- Utilize online tools: Explore online calculators and amortization schedule generators to simplify the process and gain valuable insights.

Conclusion: Empowering Financial Control through Amortization

Loan amortization offers a powerful framework for navigating the complexities of debt repayment. By understanding its mechanics and utilizing the amortization calendar, borrowers gain valuable insights into their financial obligations, empowering them to make informed decisions, manage debt effectively, and ultimately achieve financial well-being. Embracing the principles of loan amortization paves the way towards a brighter financial future, characterized by clarity, predictability, and control.

Closure

Thus, we hope this article has provided valuable insights into Unveiling the Power of Loan Amortization: A Comprehensive Guide to Financial Clarity. We hope you find this article informative and beneficial. See you in our next article!